50+ what percentage of your income should be mortgage

2 To calculate your maximum monthly debt based on this ratio multiply your. Find A Lender That Offers Great Service.

Utah Careers Supplement For Workers Over 50

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Web A conventional loan down payment is usually 20 of the cost of the home but it is possible to get a loan with less than 20 down. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Other rules consider pre-tax versus post-tax. Web The amount by which rental income should be more than mortgage payments is dependent on numerous factors such as the location investors goals financial situation. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web The 28 rule which says less than 28 of your monthly income should go to your mortgage is the most popular. Keep your total monthly debts including your mortgage.

Web 14 hours agoAn 87 Social Security cost-of-living adjustment for 2023 means beneficiaries received on average 140 per month more starting in January. Find A Lender That Offers Great Service. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and.

Find Out how much your home is Worth with Randy Beneduce. Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web The rule states that you should spend up to 50 of your after-tax income on needs and obligations that you must-have or must-do. And you should make. It breaks down as follows.

Web The Bottom Line. Keep your mortgage payment at 28 of your gross monthly income or lower. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Compare More Than Just Rates. Web A helpful rubric to use when youre budgeting is to apply the 503020 rule to your after-tax income. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

Compare More Than Just Rates. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Ad Find Out how much you can Save on your home Mortgage with Randy Benedict.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Lenders want your back-end DTI to be no higher than 43 to 50 depending on the type of mortgage youre applying for and other aspects of your.

There are some mortgage. The remaining half should be.

:max_bytes(150000):strip_icc()/one-income-two-people-2000-6da83e67f96a4e5583697998af94f9eb.jpg)

How And Why To Live On One Income In A Two Income Household

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

The 50 30 20 Rule Of Thumb For Budgeting

50 With Little Or No Mortgage You Need A Line Of Credit Canadamortgagenews Ca

:max_bytes(150000):strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

401 K Contribution Limits For 2022 And 2023

Blog Archive Foundamental

Income Finances And Debt Understanding Where You Are And Getting Back On Track Community Counselling Resource Centre

Star Agent The Path To 50 Real Estate Transactions Per Year By Michel Friedman Ebook Scribd

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Income Should Go To A Mortgage Bankrate

Over 50 In Debt And Broke 50plusonfire

50 Of The Best Money Saving Ideas For 2023

What Percentage Of Income Should Go To Mortgage

How Much House Can I Afford Moneyunder30

Middle Class Lifeboat By Paul Edwards Sarah Edwards Ebook Scribd

Smart Money Tips For Anyone Age 50 Or Older Part 1 Delta Community Credit Union

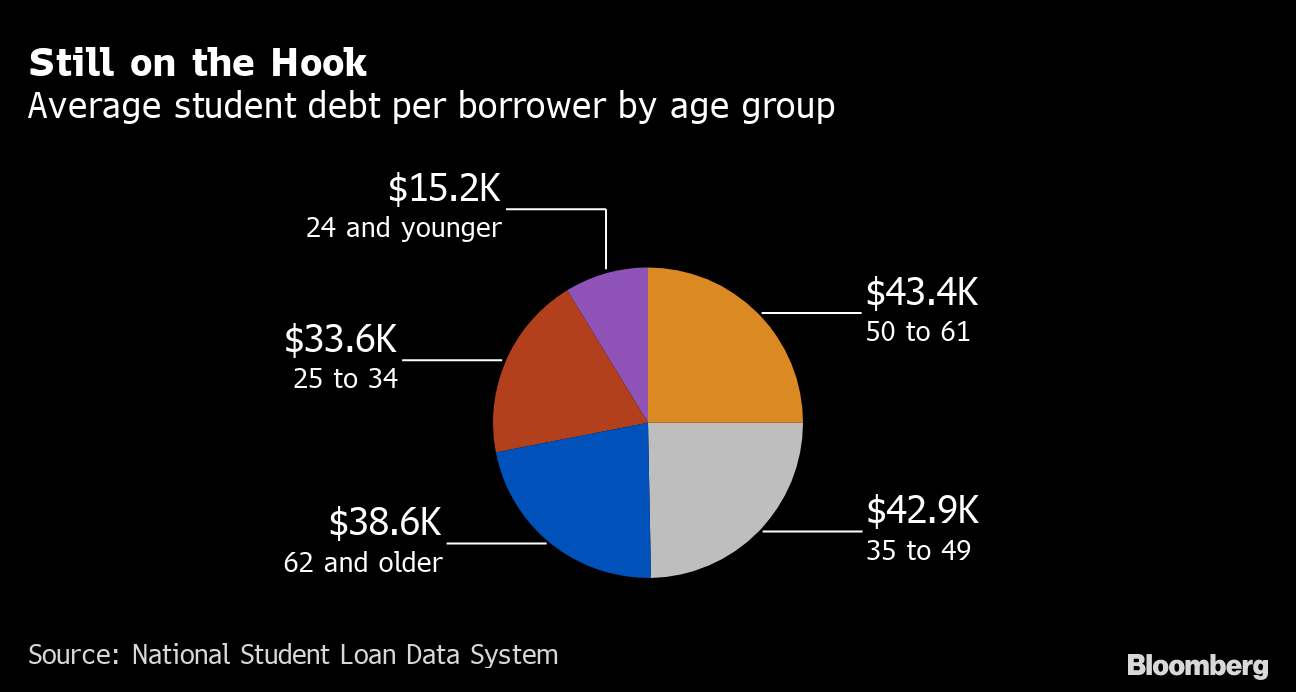

Student Loan Growing Share Of 1 7 Trillion Debt Pile Held By Older Americans Bloomberg

Read Financial Fragility Report Dec19